Our EOT Service

Being an Employee-Owned Business with specialist Corporate Solicitors and EOT Lawyers, Myerson has amassed significant expertise in advising both established employee-owned businesses and those converting to employee ownership using Employee Ownership Trusts.

We have first-hand experience with the EOT conversion process and understand what it is like to operate an employee-owned business, giving us unique, practical knowledge to guide you through every step to and beyond conversion to employee ownership. Myerson is a proud Partner Member of the Employee Ownership Association (EOA).

|

|

What is an Employee Ownership Trust (EOT)?

An Employee Ownership Trust is a trust established to own shares in a trading company for the benefit of the employees of the company, thereby creating indirect ownership of the company by the employees.

An EOT usually has at least 3 individual Trustees or a single corporate Trustee (normally a company limited by guarantee) with at least 3 directors. It is best practice for one of these individual Trustees / corporate Trustee directors to be an Independent EOT Trustee/director and for at least one EOT Trustee/director to be a serving employee who is not on the company's board of directors.

It is often the case that a board director of the company is an EOT Trustee/director, but it is best practice for board members of the company not to be a majority of the EOT Trustees/directors.

Employee Ownership Trusts (EOTs) were established in 2014 to promote employee ownership as a business model in the UK. Some of the better-known EOTs include Waitrose, John Lewis, Arup Group, and Richer Sounds.

EOT FAQs

Here are some of the most frequent questions we receive, answered by our expert EOT solicitors.

Benefits and Drawbacks of EOTs

What are the advantages of an EOT for the selling shareholders?

A key incentive for the selling shareholders is the beneficial tax treatment offered. The Finance Act 2014 offers 100% relief from Capital Gains Tax (“CGT”) provided strict requirements are adhered to, which include (amongst others) that:

- the current shareholders cease to have control, and the EOT must acquire more than 50% of the issued share capital of the company (this is known as the “Controlling Interest Requirement”);

- the benefit derived from the EOT must be to all employees (subject to limited exceptions) and must be on the same terms. Employees can receive different amounts depending on their length of service, hours worked, and remuneration, but this requires careful planning to ensure it aligns with the equality principles of the EOT legislation; and

- other conditions, including that the company is a trading company, as well as a requirement that the number of employees who own 5% of the company must not exceed two-fifths of the workforce generally (known as the “5/2 rule”).

These rules require careful consideration, and there are additional nuances to each of them. However, subject to the satisfaction of the criteria, the selling shareholders effectively get a CGT rate of 0% on the disposal of their shares.

The sale to an EOT can also offer the opportunity to the selling shareholders to either continue working in the business or allow them to retire and provide a full exit route. The EOT model allows the business to continue to operate as it has done to date and can, therefore, prove an attractive option for the company owners to preserve the company’s independence and values whilst creating a legacy for the owners.

The sale of shares to an EOT can save time and money as it provides the selling shareholders with an exit without the need to find a buyer that will conduct extensive due diligence on the company (following which they may seek to change the terms of the proposed sale or ultimately withdraw their offer to purchase) and require the selling shareholders to give a series of warranties and indemnities relating to various aspects of the company and its business. The selling shareholders will also lead the transaction, which allows them to set the timescales and control the implementation of the transition to EOT ownership.

What are the advantages of an EOT for the employees?

Under an EOT, the future profits, growth of the business and any further eventual sale will be for the benefit of the workforce as a whole.

The employees of a company that is owned by an EOT can benefit from the future success of the company and be eligible to receive an annual bonus of up to £3,600, which will be income tax-free (although the bonus will remain subject to national insurance contributions). This relief is only available, however, if certain conditions are satisfied, some of which mirror those that are applicable for CGT relief.

The EOT ownership model is an indirect employee ownership model whereby the shares in the capital of the company are held for the benefit of the company’s employees. Whilst the employees will not be able to directly control the direction of the company, sometimes companies with a larger number of employees may elect to set up an employee council, whose role will be to listen to the concerns of employees and feed those views back to the trustee which may influence how the company operates.

The sale of shares in a company to an EOT can offer continuity to the current employees as they will continue in their current roles on their present contractual terms, and there may be less change than what they may otherwise experience if the company was sold to a third-party buyer (as the selling shareholders are likely to stay in place as the company’s management team).

Are there any disadvantages of an EOT for the selling shareholders?

As there are strict qualifying conditions attached to the available tax reliefs, there is a risk that the tax reliefs could be lost if a disqualifying event occurs following the end of the tax year after the one in which the CGT relief is claimed, for instance, the Controlling Interest Requirement ceasing to be met. Usually, the trust or the company will, therefore, undertake not to take steps that would result in the occurrence of a disqualifying event and possibly even indemnify the selling shareholders against the loss of any CGT relief.

It is important to consider how many shares the EOT can afford to acquire (noting that it is customary for the purchase to be funded out of future profits), and it may be that the transition to an EOT may take many years. There are, however, debt finance and future refinance, opportunities available which may help with this.

The primary disadvantage of the EOT for selling shareholders who are not seeking a full exit is the loss of control over the company. This could lead to conflicts of interest with the selling shareholder(s) who retain a minority stake. The selling shareholders should, therefore, be comfortable with this transition of power. A shareholders’ agreement may help and is permitted under EOT ownership, provided that it does not indirectly preserve control with the selling shareholders.

Are there any disadvantages of an EOT for the employees?

There are few disadvantages for the employees, although some employees who foresee themselves as future business owners may feel that there is less scope for this under the EOT ownership structure. However, it is still possible to award employees with direct share ownership or offer share options alongside the EOT (but not to give those persons a controlling stake).

Are there any advantages for the company itself?

For the company, the EOT ownership model can help improve productivity and, in turn, the financial performance of the company, as employees feel incentivised as they have an indirect stake in the business.

EOT ownership can also assist with the recruitment and retention of employees as it can act as a key differentiating factor of the company within the market in which it operates.

Financial & Tax Considerations

What tax reliefs are available for employee-owned businesses?

Under the Finance Act 2014, the UK government made using EOTs very attractive by granting a number of highly beneficial tax reliefs:

- Any individual who disposes of shares in a company to an Employee Ownership Trust will be exempt from capital gains tax (CGT). This will become more important in the future with rumoured changes to the rates of CGT and the removal of Business Asset Disposal Relief;

- A company owned by an EOT can pay each employee an annual bonus of up to £3,600 free of any income tax (the Employee Ownership Association has called for this to be increased to £4,400 per annum) ; and

- There is relief from inheritance tax on certain transfers into and from the EOT.

There are several conditions that need to be satisfied to obtain the tax reliefs, including:

- The EOT must hold more than 50% of the company's ordinary share capital. Many EOTs own 100% of the trading company, but this does not necessarily need to be the case, and other HMRC-approved share schemes such as EMI, CSOP and SIPP Schemes can, subject to meeting the relevant eligibility criteria, also be used in connection with a company that is majority owned by an EOT;

- The benefits of the EOT must be available to all employees;

- All employees must be treated equally (subject to some limited exceptions);

- The target company must be trading; and

- The business cannot benefit from the tax reliefs if it is a partnership or limited liability partnership (LLP). However, most trading partnerships or LLPs can convert to a limited company in a tax-efficient manner just before becoming employee-owned through an EOT - this is what Myerson did before becoming employee-owned!

Other conditions may apply, so it is crucial to conduct an eligibility assessment at an early stage of planning, with the support of specialist EOT advisers such as Myerson, to successfully implement employee ownership through and benefit from the aforementioned tax reliefs. We can work with you and your accountant or tax advisors to ensure that the structure and your trading company are correct.

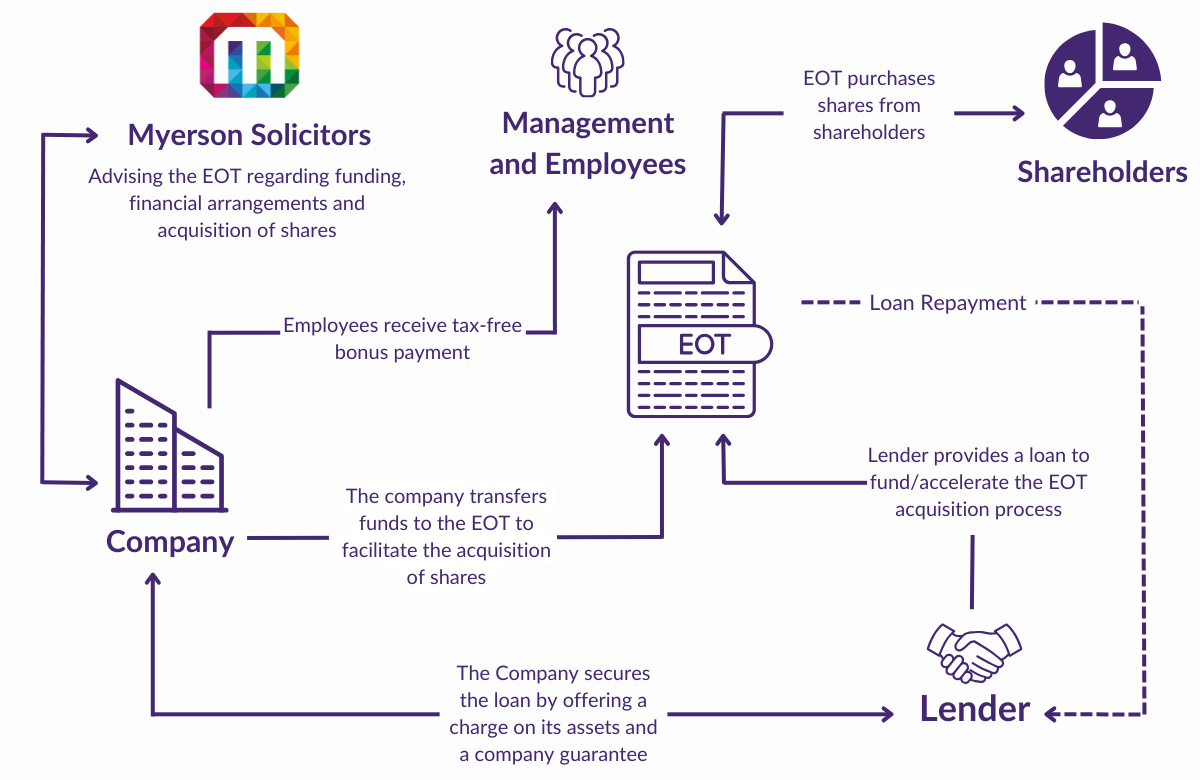

What are the funding options for an EOT?

It is common for some of the purchase prices for the shares sold by the selling shareholders of the company to be funded by way of the company’s current cash reserves (usually the payment on completion), with the balance of the price being paid to the selling shareholders on deferred payment terms using future profits.

In most cases, therefore, the EOT will be reliant on the future financial performance of the company to enable the EOT to pay the selling shareholders. It will be important for the EOT to accordingly consider company cash flow, and any share purchase agreement documenting the sale of the shares will need to include flexible repayment terms to accommodate changes in the company’s financial performance.

It is, however, possible to source third-party lending to fund a proportion of the purchase price due to the selling shareholders. If security is required by the third-party lender (which is most likely to be the case), it will be important to consider an event of default on the terms of the loan and the security which may enable the lender to acquire control of the company (and so result in a disqualifying event under the governing legislation for EOT’s meaning any tax reliefs for the benefit of the selling shareholders may be lost).

Legal & Structural Considerations

What needs to be considered as part of the sale process?

As part of the sale process, you will need to consider various factors, including:

- Share Purchase Agreement – Effectively, the sale of the shares will be a form of management buy-out, with the EOT Trustees representing the employees, and will need to be negotiated accordingly;

- Valuation and funding – Typically, it is best practice to carry out an independent valuation of the company and determine a fair market value. The purchase price payment is commonly funded from current cash reserves and future profits. However, debt finance is also an option which can be explored. We have strong working relationships with valuation experts, and we can refer you to those who have experience and expertise in valuing businesses in connection with EOT share transactions;

- Deferred consideration – Depending on the funding, it is common for the purchase price to be paid on a deferred basis, often over several years. Consideration will need to be given to cash flow, how to best structure the payment terms and, whether security is necessary (and the extent of such security without breaching the rules to meet an EOT transaction) and whether interest is to be paid on the deferred consideration. In certain circumstances, the payment of deferred consideration may be accelerated, and it is common for there to be an agreed list of “restricted transactions and matters” that will apply whilst monies are outstanding to sellers;

- Management Team – It is key to ensure that the management team “buy in” to the deal as they will be key to ensuring the future success of the company and that any deferred payments are made; and

- Shareholder arrangements – Where a seller is retaining any interest in the company post-completion, a shareholders’ agreement (and suitable articles of association) will need to be considered, and the appropriate documentation produced to manage those relationships. One key consideration will be whether there should be any put and/or call option arrangements in place in relation to any residual minority shareholding that is retained by the sellers;

- Profit Distribution Policy – Often, the sellers, the trading company and the EOT Trustee(s) will agree on a profit distribution policy in relation to the payment, deferred consideration, bonuses to employees and management and retention of working capital;

- Establishment of the EOT Trust - Whilst certain standard terms have to be considered and included (such as the rules requiring equality between the employee beneficiaries), other specific options to suit your circumstances need to be considered, such as the number of EOT trustees you should have, whether a trust company should be the sole trustee, whether you should have an Employees Council or an Employees Engagement Committee, and if so, what “constitutional” status they will have. Most EOTs will use a trust company limited by guarantee as their sole EOT trustee, and in this scenario, the trust company will need special articles of association to govern how the trust company and its directors operate on its behalf as the trustee of the EOT;

- Tax Clearances - You will almost certainly need to obtain special HMRC tax clearances to facilitate the establishment of an EOT and the ability for the company to make “contributions” from profits of the company to the EOT to pay share consideration and transaction costs such as stamp duty, so they are not taxed further after the company has paid corporation tax on such profits; and

- Employee and stakeholder Communications - Many advisers talk about the legal, tax, and financial aspects of an EOT conversion process, but a major element in any process to successfully conclude an employee ownership project is stakeholder and employee communications. The impact on every stakeholder in connection with a business needs to be considered before embarking on a conversion process, and then, after appropriate consultation, an Employee and stakeholder EOT Communications Plan and Process should be created to maximise the beneficial impacts that can be achieved via employee ownership.

In some cases, an EOT has not proven to be a suitable structure for certain clients.

In such instances, we have worked closely with them to consider the requirements of all parties in order to agree an alternative structure which benefits the relevant stakeholders, although not necessarily with the same tax benefits.

Who will act as the trustees of, and manage, the EOT?

The trustee of an EOT can be an individual or a corporate trustee (e.g. a private company limited by guarantee). It is usually recommended to use a corporate trustee, where the individuals who would be trustees of the trust would be appointed as directors of the corporate trustee. This saves the administrative “headache” of retiring/appointing trustees, as the appointment and retirement of directors is much simpler. Furthermore, as acting as a trustee brings with it significant responsibilities, trustees can be sheltered from personal liability if they perform their role by acting as a director of a corporate trustee, which provides limited liability (although the responsibilities and duties of acting as a director of course remain).

It is important to have a broad make-up of the trustees/directors of the EOT, essentially ensuring that the selling shareholders(s) (who can be trustees/directors) do not have control. It is usual that an independent trustee be appointed along with a representative of the employees of the company. In contrast, it is not necessary for the make-up of the board of the company to drastically change, other than to perhaps involve more of the (non-selling shareholder) senior management.

Can you use employee share option schemes within an EOT?

Yes, it is possible to use an employee share option scheme in conjunction with an EOT.

This requires careful tax and legal planning, but it is becoming more common for EOTs to utilise schemes such as EMI, CSOPs and Growth Shares, designed to specifically incentivise key personnel separately to the incentives conferred by the trust.

What’s the difference between an ESOP and EOT?

An employee stock ownership plan (ESOP) is a broad term which generally refers to employees obtaining options to acquire shares in a company. Typically, these might take the form of tax incentivised share schemes (such as an EMI scheme, or a CSOP scheme). They are generally designed to incentivise employees by facilitating gradual vesting and smaller ownership stakes on an individual basis.

An EOT is distinct from an ESOP for several reasons. Firstly, an EOT does not have individual employees obtaining shares or options, nor do individual employees have specific entitlements to shares. Rather, the trust will acquire and hold a controlling stake in the company on behalf of all the employees.

When exploring employee ownership, it is important to carefully consider the various alternatives, as there are pros and cons with each model, and the best fit will depend on a number of factors. It is also possible to combine different structures.

Legislative & Policy Updates

How did the 2024 Autumn Budget impact EOTs?

The 2024 Autumn Budget introduced changes that have implications for Employee Ownership Trusts (EOTs), with much of the focus being on anti-abuse provisions and tightening of the rules in line with recommendations made by the Employee Ownership Association (EOA).

The changes included stronger restrictions on the requirement for sellers to relinquish control and extending the period for disqualifying events in the context of the capital gains tax relief.

The budget also highlighted EOTs as a beneficial structure for fostering sustainable business growth and encouraging employee involvement in ownership, which aligns with broader government goals of promoting economic resilience and shared success. Notably, the Labour government reinforced its commitment to this model, possibly enhancing the appeal of EOTs for businesses considering succession planning.

For more detailed insights, refer to our article here.

Employee Ownership Trusts (EOTs): Benefits, Challenges & Tax Considerations

A Guide to Employee Ownership Trusts (EOT)

How We Can Help You Establish an Employee Ownership Trust

We have significant first-hand experience in advising clients on establishing and creating EOTs.

While creating an Employee-Owned Business has many advantages, there are some pitfalls, and it is important to take professional advice in planning and structuring the transaction.

Having transitioned to 100% employee ownership ourselves, we understand the importance of a comprehensive and transparent process, ensuring that legal, tax, financial, and people-focused elements are seamlessly integrated.

Key considerations when setting up an EOT include:

- Share Sale Structure: Selling more than 50% (often 100%) of the company's shares to the EOT.

- Valuation and Funding: Establishing fair market value, exploring EOT funding options (current cash reserves, profits, or debt finance), and structuring payments.

- Deferred Consideration: Managing payment terms, cash flow, and potential security or interest arrangements.

- Management Team Buy-In: Ensuring leadership commitment to the transition for long-term success.

- Shareholder Agreements: Drafting agreements for retained interests, including options for future buyouts of minority stakes.

- Profit Distribution Policy: Balancing payments, employee bonuses, and working capital needs.

- EOT Trust Establishment: Tailoring trustee and governance structures to your needs.

- Tax Clearances: Securing HMRC approvals to maximise tax efficiencies.

- Stakeholder Communication: Crafting a robust Employee and Stakeholder Communication Plan to foster engagement and clarity.

Sometimes, an EOT is not a suitable structure for certain clients. In such instances, we have worked closely with them to consider the requirements of all parties to agree an alternative structure which benefits the relevant stakeholders, although not necessarily with the same tax benefits.

Why Work With Our EOT Specialist Lawyers?

- As an employee-owned business ourselves, with our own Myerson EOT Trust, we have first-hand experience of the process and unique insights into structuring EOTs.

- As well as providing financial, legal and governance advice, we take into account the workplace culture and people aspects involved in becoming employee-owned and we will help you develop and execute an Employee and Stakeholder EOT Communications Plan.

- We have a specialist EOT team with extensive experience helping organisations across a diverse range of sectors transition to employee ownership.

- At Myerson, we are proud to be a full-service law firm, offering businesses comprehensive legal support across various areas, including employment, commercial, and corporate law. Our integrated approach ensures that we not only guide you through the Employee Ownership Trust (EOT) process but also address related legal needs that may arise as part of your business's growth and transformation.

- We can advise EOT Trustees on all aspects of their role in connection with the establishment of an EOT Trust, the EOT conversion transaction and EOT governance.

- Our team can guide you on the constitution and operation of EOT Employee Councils and Employee Engagement Committees.

- We are Partner Member of the Employee Ownership Association (EOA).

- Our specialist EOT lawyers work with a network of trusted specialist advisors, accountants, tax specialists and valuation experts.

- We have been ranked as a Top Tier law firm by the Legal 500 for corporate work for the last seven years.

- You will receive city-quality corporate and employment law advice at regional prices.

- We have advised on numerous conversions to employee ownership through an EOT, including our own transition to 100% employee ownership!

Take a look at the Myerson Promise for further benefits of working with us.

Employee Ownership Trusts (EOT) Case Studies

Case Study 1 - Home Legal Direct's Transition to Employee Ownership

Myerson Solicitors assisted Home Legal Direct, a leading conveyancing service provider, in transferring majority ownership to an Employee Ownership Trust (EOT). This model secures the company’s long-term growth and enhances workplace culture by involving employees in ownership.

Myerson’s corporate team guided Home Legal Direct through structuring and implementing the EOT, ensuring legal compliance and strategic alignment with the company’s values.

Oliver Meddick, co-founder and Chief Operations Officer of Home Legal Direct, said:

“Becoming employee-owned not only empowers our people and secures our future but also strengthens our commitment to providing excellent service to our clients. After exploring several succession planning options, we found that the EOT model was the best way forward, offering attractive benefits for both us as selling shareholders and our employees. We are very grateful for the expertise and guidance provided by Terry Moore, Simon Nolan, and the rest of the Myerson team.”

Case Study 2 - Progression Solicitors’ Transition to Employee Ownership

In October 2024, Myerson facilitated Progression Solicitors' transition to an Employee Ownership Trust (EOT). Founded in 2005, Progression Solicitors, with five offices in North Lancashire, embraced employee ownership to maintain its management structure while empowering staff with a stake in the firm.

This transition, guided by Myerson’s corporate team, is part of an industry-wide shift enhanced by recent tax changes, making EOTs increasingly attractive.

The move reinforces Myerson’s position as a leader in EOT conversions, offering an effective succession plan that sustains both company culture and operational stability.

Anthony Smith, Managing Director of Progression Solicitors expressed his enthusiasm:

“Becoming an employee-owned firm is a proud moment for all of us at Progression Solicitors.

This change is a testament to our dedication to our team and allows us to continue providing exceptional legal services with the added benefit of empowering our employees.

Knowing that our people have a genuine stake in the business strengthens our commitment to each other and enhances our focus on serving our clients and supporting our community.”

Case Study 3 - entitledto's Transition to Employee Ownership

Myerson Solicitors supported EntitledTo, a leading benefits calculation technology provider, in transferring a majority stake to an Employee Ownership Trust (EOT). This transition ensures the company’s long-term independence and empowers employees by involving them in ownership.

Myerson’s corporate team provided expert guidance throughout the process, including structuring the transaction, securing tax clearances, and establishing the EOT in alignment with EntitledTo’s values and goals.

Speaking about the transition, the founders of EntitledTo commented:

“Becoming employee-owned secures our future while rewarding the team that has contributed to our success. The EOT model aligns with our mission and values, offering benefits for both the business and employees. We are grateful to Myerson’s team for their expertise and support in guiding us through this transformative process.”

Read more about entitledto's transition.

Testimonials

Meet Our EOT Specialists

Home-grown or recruited from national, regional or City firms. Our EOT specialists are experts in their fields and respected by their peers.

Contact Our Experts

You can contact our lawyers below if you have any more questions or want more information: